Mark Salzberg accepts 2024 Trustees’ Award American Numismatic Society President Ute Wartenberg.

Mark Salzberg does not fit the profile for most American Numismatic Society honorees. He is not a numismatic scholar. Nor is he a well-known specialist collector or even dealer. Instead, Salzberg was honored at a gala dinner at the Harvard Club in New York City in January 2024 for something far more profound, transforming coins and other collectibles into “an asset class.”[2]

Mr. Salzberg’s profile on “Linked-in” sums up his accomplishments quite well. He states,

“I started in the collectibles industry as a coin dealer in 1980 and joined Numismatic Guaranty Corporation (NGC) as a grading finalizer in 1988. Ten years later, I became the CEO of NGC and then founded the Certified Collectibles Group (CCG) the following year. CCG now comprises eight of the world’s leading expert and impartial services companies for coins, paper money, comic books, magazines, concert posters, trading cards, sports cards, stamps and other collectibles.”

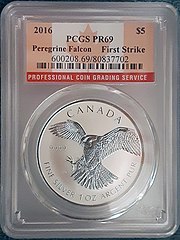

A Canadian Peregrine Falcon silver coins graded by Professional Coin Grading Service, 21 February 2022, Author Viiticus, CCA-SA 4.0 International license.

The development of third-party grading is by far the most impactful change ever to happen to the collectibles industry. When I became a collector 40 years ago – before third-party grading – the market was fraught with risks and uncertainty. Most collectors and dealers did not know how to grade collectibles or identify counterfeits. A small number of experts possessed all of the knowledge. Today, anyone can buy a collectible certified by a CCG company and have total confidence that it is genuine and accurately graded. This has enabled collectibles to develop into an asset class, bought and sold in a robust global, online and even sight-unseen market.[3]

NGC is one of several third-party grading services, which typically package authentication, grading, valuation, registration (in their databases), and encapsulation services together along with add-ons, the most important of which is conservation.[4]

All the third-party grading services market this package to less experienced collectors as a way to guarantee authenticity and condition and hence value. While this may be true in a general sense, the problem is that more experienced collectors know it is just not that simple.

Grading is by its nature subjective, and standards have changed over time based on each company’s internal procedures which are not reported publicly. Overall, the industry has been criticized for gradually loosening its grading standards. This in turn has created a ‘cottage industry’ of coin market speculators who break coins out of old slabs in order to resubmit them to a service, hoping to achieve a higher numerical grade that may translate into a higher resale price. One unfortunate consequence of all this speculation is that the population reports produced by the grading services must be taken with a grain of salt. Given this practice, such reports have been inflated by double counting coins that have been resubmitted. Of course, the data only relates to slabbed coins; other coins are not counted in such data.

Coin slabs, 12 November 2023, Author Bruxton, CC0 1.0 Universal Public Domain Dedication

There are more basic issues with grading. The 70-point scale that NGC and other third-party grading services use makes little sense to most people, who are more used to a 10- or 100-point scale. The grading services adopted it from a system devised in the 1940’s by Dr. William Sheldon to grade early U.S. large cents. Sheldon thought that numerical grades could add precision to traditional written descriptions of a particular coin’s condition as “good,” “very good,” “fine,” “very fine,” “extra fine,” and “uncirculated.” NGC has experimented with a 10.0 system,[5] but it remains to be seen if it will replace the 70-point scale, particularly when so many coins have already been graded under the old system.

While artificial intelligence (AI) may help in the future, so far, the results have not been good enough, so consistent grading across services and individual graders remains a problem.

The key issue is that collector expectations fostered by third-party grading services do not necessarily match reality. Price guides typically give specific prices for coins in particular numerical grades. However, what less experienced collectors fail to understand is that ultimately eye-appeal trumps a numerical grade. For example, experienced collectors know that an AU-58 (“Almost Uncirculated 58”) coin with eye appeal could very well be worth more than a less visually appealing specimen that is technically uncirculated, i.e., MS-60 (“Mint State-60).

In response, third-party grading services have moved towards “market grading” at least for some scarcer issues that are also popular with collectors. “Market grading’s” supporters describe it as a pragmatic realigning of the grade to consider additional factors that affect the price. The goal is to make a coin’s numerical grade more reflective of its actual value than a technical grade based on wear alone.

Coin show crowd, 12 November 2023, Author Bruxton, CC0 1.0 Universal Public Domain Dedication.

Another important aspect of “eye appeal” is the coin’s surface. That raises another issue. Encapsulated coins are not placed in completely air-tight holders. This means that if a coin is slabbed without also paying to conserve its surfaces, over time contaminants can show up as obvious imperfections on a coin previously given a high numerical grade, for example MS-63. Latent fingerprints are a prime example. Before a coin is slabbed, its surfaces may look pristine. However, years later such fingerprints may show up quite clearly and distractingly on an otherwise high grade specimen.

Many collectors find authenticity guarantees to be the most important part of the package that the services offer. Here, however, collectors face a “Catch 22” situation. Coins that are authenticated and graded are then placed in tamper-proof slabs, which often obscure details, particularly on the edge of the coin. Once slabbed, it is impossible for other experts to render their own opinions whether the coin is authentic, which typically involves examining the edge for any evidence of casting, a favored way of making fakes. However, breaking the coin out of its slab will typically void any of the grading company’s guarantees, effectively making them illusory.

Even worse, counterfeiters take advantage of this “Catch 22” by placing high quality counterfeits of a particular coin in an equally deceptive counterfeit slab. While grading services now upload high quality images of the coins they slab onto the Internet, it’s not always that easy to tell if a coin and its slab have been copied. Moreover, coins slabbed years ago may not have ever been imaged in the first place.

El Cazador 8 Real Coin, 23 February 2017, Author HblairH, CCA-SA 4.0 International license.

After slabbing U.S. and then foreign coins, the third-party grading services have gradually expanded into other areas, including ancient coins, paper money, comic books, magazines, concert posters, and trading cards. Each of these has its own issues. Slabbing ancient coins has been controversial with specialists. Handling such coins does not raise the same concerns as it does with modern coins with their smooth surfaces. Indeed, the tactile experience of holding ancient history in one’s hands is an important reason collectors are drawn to ancient coins in the first place. However, this “hands-on” experience is impossible when it comes to slabbed coins, and many serious collectors “free” coins from their slabs after purchase. Another issue relates to provenance, which becomes ever more important as collectors face more trade restrictions on importing ancient coins. The process of encapsulating a coin provides good evidence to prove that a coin was in the collector market as of a certain date, but all too often when a coin is slabbed other earlier evidence, in the form of information contained on envelopes or card stock that accompanied the coin, is simply discarded.

Similar issues arise for other collectibles like comic books which can no longer be opened once graded and encapsulated. Another issue for such collectibles is the added cost associated with the grading company handling such fragile items.

Overall, third-party grading and encapsulation is a “glass half-full” or “glass half-empty” phenomenon. While claims that professional third-party grading and encapsulation converts coins and other collectibles into a secure investment may be more hype than reality, the truth is that grading and encapsulation add a level of assurance for new collectors which has helped grow the market.

The author would like to thank fellow coin collector Jason Tungli for his input into this article.

Next Installment: The Advantages of Buying from Members of Established Trade Associations

Further Reading:

Grading

Alexis Culotta, How to Grade Coins: Tips for Beginner Professional Coin Collectors and Hobbyists, In Good Taste, Invaluable.com (updated March 19, 2024).

[1] Peter K. Tompa is a semi-retired lawyer who resides in Washington, D.C. He has written extensively about cultural heritage issues, particularly those of interest to the numismatic trade. Peter contributed to Who Owns the Past?” (K. Fitz Gibbon, ed. Rutgers 2005). He formerly served as executive director of the Global Heritage Alliance and now is a member of its board of directors. (https://global-heritage.org/) This article is a public resource for general information and opinion about cultural property issues and is not intended to be a source for legal advice. Any factual patterns discussed may or may not be inspired by real people and events.

[2] See 2024 Annual Dinner Honoring Mark Salzberg, American Numismatic Society.

[3] Linked-in entry for Mark Salzberg, 2nd, Certified Collectibles Group Founder.

[4] See What is the Value of a TPG (Third Party Grader) Certification?, Coin Talk Forum (Discussion started Nov. 3, 2021). In addition to NGC, PCGS, ANACS, and CAC offer similar services.

[5] See NGCX a new 10-point grading scale from NGC, Coin Talk Forum (Discussion started Nov. 16, 2022), and https://www.cointalk.com/threads/ngcx-a-new-10-point-grading-scale-from-ngc.400985/page-7#post-24858666.

Coin slabs, 12 November 2023, Author Bruxton, CC0 1.0 Universal Public Domain Dedication

Coin slabs, 12 November 2023, Author Bruxton, CC0 1.0 Universal Public Domain Dedication