Four out of 10000 unique VeKings. VeKings are a collection of 9,999 unique non-fungible tokens (NFT) stored on VeChains digital ledger (blockchain). 22 October 2021, Author RingrEven, CC0 1.0 Universal Public Domain Dedication.

Dorothy Jones, known to her friends as Dot, is 24 years old. She makes a good living in the tech industry and is looking to invest some extra money in art she can enjoy now and perhaps sell for a profit later. Dot’s parents, Jean and George, are avid collectors of “Pop” art. Dot inherited her love of art from them. Someday, she also hopes to decorate her own home with lots of art. Right now, however, she lives in a small studio apartment in New York City. There simply isn’t much wall space, and she worries that any valuable art she purchases might get damaged in an anticipated move across country necessitated by her job. Dot also is concerned about the inherent costs that come with any collection, like framing, lighting and insurance. Under the circumstances, buying art simply doesn’t seem very feasible to her at the moment.

Or maybe it is! Dot was fascinated to learn on the Internet that art can be stored on her iPhone. This art is referred to as NFTs. What are NFTs? NFTs stands for “non-fungible tokens” which can take the form of digital images of modern and traditional art, avatars, sports memorabilia, video clips, and designer fashion. NFTs are “non-fungible” because computer code called blockchain makes each unique. This uniqueness also distinguishes them from “fungible” bitcoin which can be traded for other, identical cryptocurrency. NFTs were first conceived in 2014 as a way to track the provenance of digital artwork and to provide a mechanism for an artist not only to sell their work, but to receive a continuing income stream of royalties. The idea took some time to take off, but by March 2021, something akin to 17th century Dutch “Tulipmania” had set in, exemplified by the sale of a single token by a Digital artist named “Beeple” for almost $70 million.

Tong Tak Street taxi body ads for NFT, HK SKD TSO zh:將軍澳 Tseung Kwan O zh:唐德街, 20 March 2022, Author Goyaiwu Chuaillau, CCA-SA 4.0 International license.

So, what do you actually get when you purchase an NFT? You do receive an “original work” in the sense that each NFT is unique, but that doesn’t mean the NFTs’ image can’t be replicated over and over again. Thus, an individual NFT can be more analogous to a print or even a trading card than an original artwork. There also is that eternal question, “But is it art?” Some NFTs, like those created in association with established museums, can have considerable artistic merit. Others, however, have a cartoonish quality, more like the imagery from a video game than great “art.” The similarities between such NFTs and video game images are often quite intentional. Some NFTs are also used as gaming pieces, with the option to purchase additional powers to gain an advantage over other players. Still other NFTs can act as tokens to be used to establish membership at hip club or to act as tickets at an event. For such uses, the NFTs’ blockchain acts as an anti-counterfeiting device and allows the issuer to establish different levels of benefits for each NFT holder. Indeed, such characteristics may save the likes of Ticketmaster from ruin. Properly employed, NFTs may be a panacea allowing Ticketmaster to crack down on forgeries and bots, while offering different experience levels to ticket holders through the use of blockchain.

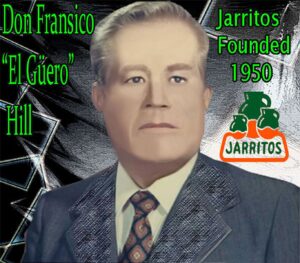

Jarritos bottled soft drink soda. Art/NFT image in honor of the founder DON FRANSICO “El Güero” Hill. Year 1950. 4 January 2023, Author Aztec Crypto Garden, CCA-SA 4.0 International license.

NFT values are all over the place, and seemingly have little to do with artistic merit or even common sense. For example, on November 23, 2022, “Bored Ape Yacht Club NFT # 232” sold for approximately $927,000 in cryptocurrency. While most “Bored Ape” NFTs have lost money in recent months, this particular NFT evidently sold at such a strong price because it is considered one of the “rarer” types with less than 0.5% of the apes in the series exhibiting similar golden fur.

While one can question the rationale behind some NFT purchases, the money that NFTs have generated has also attracted outright scammers. Recently for example, federal prosecutors in New York charged Aurelien Michel, a French national residing in the United Arab Emirates, with defrauding purchasers of “Mutant Ape Planet” NFTs of more than $2.9 million in cryptocurrency. According to a government press release, Michel defrauded investors by making false representations about giveaways, tokens with staking features, and merchandise collections. Once the NFTs were sold-out, Michel perpetrated a “rug pull scheme” by pocketing the cryptocurrency rather than making good on his promises.

Live auction of Paweł Kowalewski’s NFT work entitled “Why is there something rather than nothing?” at the DESA Unicum auction house in Warsaw, on December 2, 2021. Author Ojdobrzejuz, CCA-SA 4.0 International license.

Just like Dutch “Tulipmania,” speculative prices for NFTs led to the creation of a bubble that ultimately burst. When the cryptocurrency market was hot, it also pumped up the market for NFTs which are mainly purchased with bitcoin. In August 2021, Open Sea, the largest NFT marketplace, hit $3 billion in monthly sales volume, following a sellout of 10,000 of its Bored Ape Yacht Club “Mutant ape” series NFTs. However, after the collapse of FTX and the ensuing fallout for the rest of the industry, there was a major correction in the NFT market, including that for “Bored Apes.” For example, one purchased by singer Justin Bieber for $1.3 million earlier in 2022, was only worth $69,000 a few months later. Still, some “blue chip” NFTs, like “Bored Ape Yacht Club # 232,” have retained their value, presumably due to their perceived “rarity.” Moreover, it is likely that the market in virtual art will recover much of its losses over time simply because Generation Z collectors like the convenience of storing NFTs on their phones and are drawn to the gaming aspects of some NFTs.

And what about Dot? The good news is that she only jumped into NFTs after the market correction, and being a smart collector like her parents, she is only spending what she can afford on them for her own enjoyment, without any delusions she will “make a killing.”

Next Month: The New Collectors from Abroad

Peter K. Tompa has written extensively about cultural heritage issues, particularly those of interest to the numismatic trade. Peter contributed to Who Owns the Past?” (K. Fitz Gibbon, ed, Rutgers 2005). He formerly served as executive director of the Global Heritage Alliance and now is a member of its board of directors. This article is a public resource for general information and opinion about cultural property issues and is not intended to be a source for legal advice. Any factual patterns discussed may or may not be inspired by real people and events.

Further reading:

Mitchell Clark, NFTs, Explained, The Verge (June 6, 2022)

Joel Khalili, The Year the NFT Died and Came Back to Life, Wired (December 22, 2022)

On Bored Apes

Morgan Chittum, OpenSea Hits $3B in Monthly NFT Volume, Blockworks (August 30, 2021).

Andrew Heyward, NFTs Are Dead? Even in Bear Market, a Bored Ape Sells for Nearly $1 Million, Decrypt (November 23, 2022)

On Scams

Non-Fungible Token (NFT) Developer Charged in Multi-Million Dollar International Fraud Scheme, U.S. Attorney’s Office, Eastern District of New York (January 5, 2023)

On Tulipmania

Adam Hayes, Tulipmania: About the Dutch Tulip Bulb Market Bubble, Investopedia (updated November 22, 2022)

Just for Fun

Elon Musk, I’m selling this song about NFTs as an NFT, Twitter @ElonMusk (March 15, 2021)

HK CWB zh:銅鑼灣 Causeway Bay MTR Station, 3 September 2022, Author Liam Chucao Maixlld, CCA-SA 4.0 International license.

HK CWB zh:銅鑼灣 Causeway Bay MTR Station, 3 September 2022, Author Liam Chucao Maixlld, CCA-SA 4.0 International license.